- IRS forms

- Form 540

540 Tax Form: California Resident Income Tax Return

Download form 540Tax season can be a stressful time for many individuals and businesses. With numerous tax forms and complex regulations, it's essential to have a thorough understanding of the process to ensure compliance and maximize potential refunds.

Tax form 540 is an essential document used for filing state income taxes in certain U.S. states. It is primarily used by residents of California, where it replaces the standard federal income tax return. The form enables taxpayers to report their income, deductions, and credits for state tax purposes. It's crucial to note that the 540 tax form comes in different versions, such as the form 540 2EZ, 540A, and 540NR, depending on the taxpayer's specific circumstances.

In this article, we will discuss the intricacies of the 540 tax form, shedding light on its purpose, eligibility criteria, and key components. Whether you're an individual or a business owner, this comprehensive guide will equip you with the knowledge needed to navigate the 540 tax form effectively.

What is California Form 540?

Form 540 is the California Resident Income Tax Return used by residents of California to file their state income taxes. This form is similar to the federal Form 1040 but is specific to California state tax laws and regulations. Understanding how to complete Form 540 is crucial for ensuring accurate and timely filing, which helps in avoiding penalties and maximizing potential refunds.

Who Is Eligible To File Tax Form 540?

Tax Form 540 is specific to the state of California and is used for filing individual income tax returns. Eligibility to file Form 540 depends on several factors, including your residency status, income level, and filing status.

Here are some general guidelines:

- California residents: If you are a resident of California for tax purposes, you are eligible to file Form 540.

- Non-residents with California source income: If you are not a California resident but have income from California sources, such as rental property or business income earned in California, you may need to file Form 540NR (Nonresident or Part-Year Resident Income Tax Return) instead.

- Income threshold: Generally, you are required to file Form 540 if your gross income exceeds the filing threshold set by the California Franchise Tax Board (FTB). The income threshold can vary depending on factors such as filing status and age.

- Filing status: You can file Form 540 if you have one of the following filing statuses: single, married/RDP filing jointly, married / RDP filing separately, head of household, or qualifying widow(er) with dependent child.

It's important to note that tax laws and requirements can change over time, so it's recommended to consult the most up-to-date information provided by the California Franchise Tax Board or seek advice from a tax professional to determine your eligibility to file Form 540.

Benefits of Filing Tax Form 540

Filing Tax Form 540, also known as the California Resident Income Tax Return, offers several benefits for taxpayers residing in California

Here are some advantages of filing this form:

State income tax calculation

Form 540 allows you to report your income and calculate your state income tax liability accurately. Filing this form ensures that you comply with California state tax laws.

Claiming california tax credits

The form enables you to claim various tax credits offered by the state of California. These credits can help reduce your overall tax liability, potentially resulting in a lower tax bill.

Itemized deductions

If you choose to itemize deductions instead of taking the standard deduction, Form 540 provides the necessary sections to report deductible expenses such as mortgage interest, property taxes, charitable contributions, and medical expenses.

Reporting california-specific adjustments

California has specific adjustments to income that differ from federal tax rules. By filing Form 540, you can report these adjustments accurately, ensuring compliance with California tax regulations.

Supporting California tax withholding

If you are an employee, Form 540 helps reconcile the state income tax withheld from your paychecks with your actual tax liability. Filing this form allows you to determine if you have overpaid or underpaid your state taxes and take appropriate action.

California tax refunds

If you overpaid your state income taxes throughout the year, filing Form 540 enables you to claim a refund for the excess amount. This form is necessary to initiate the process of receiving a refund from the state of California.

Compliance with state reporting requirements

Filing Form 540 ensures that you meet your obligations as a California taxpayer. By submitting the form by the designated deadline, you avoid penalties and interest charges associated with late filing.

Documentation for future reference

Filing Form 540 provides a record of your income, deductions, and tax payments for a particular tax year. This documentation can be helpful for future reference, financial planning, or in case of an audit.

How To Complete Form 540: A Step-by-Step Guide

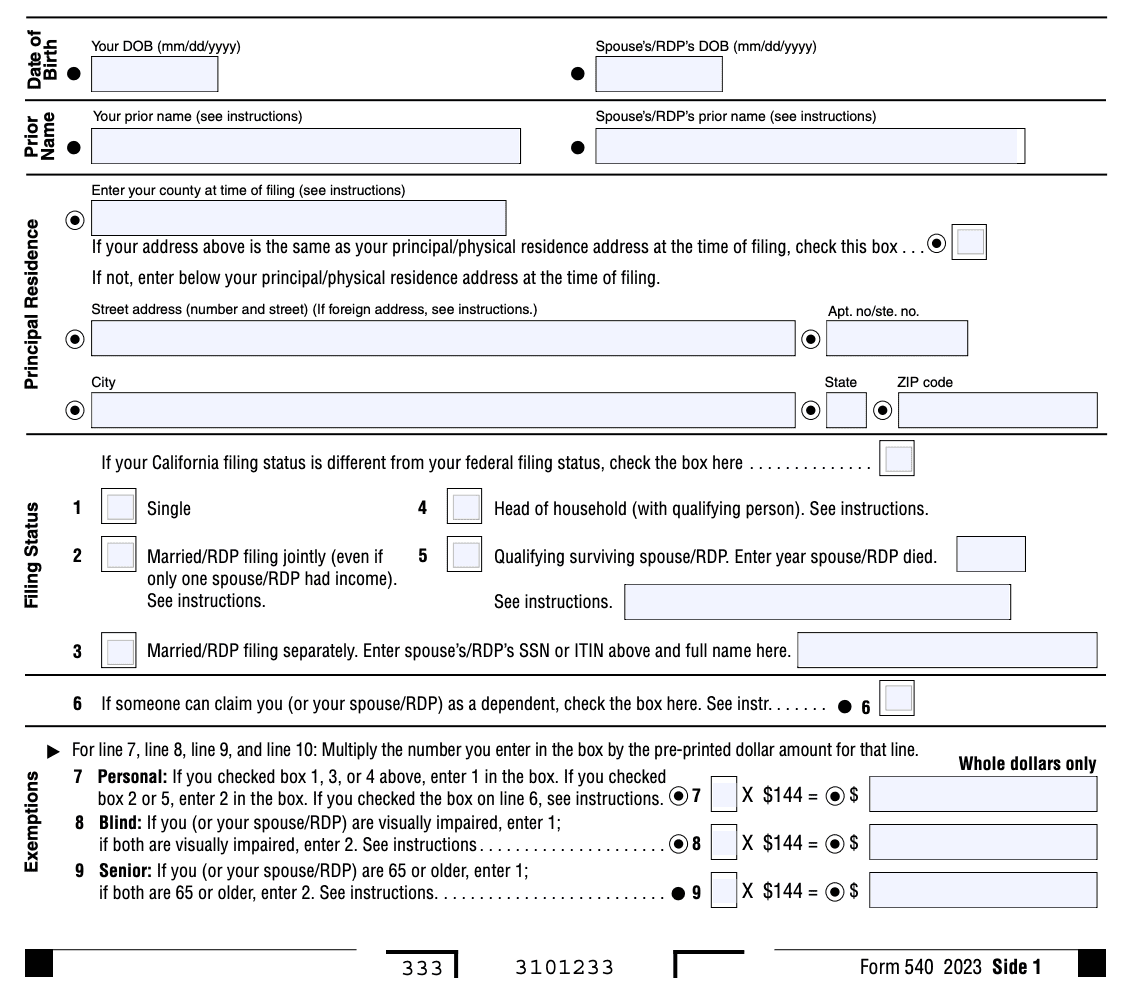

Completing Form 540 can seem daunting at first, but with a step-by-step approach, it becomes more manageable. Here's a general guide on how to complete the form:

Step 1: Gather required information and documents

Collect all the necessary information and documents before you begin. This includes your Social Security number, W-2 forms, 1099 forms, receipts for deductions, and any other relevant financial records.

Step 2: Provide basic information

Start by filling in your personal information at the top of Form 540. This includes your name, address, Social Security number, filing status, and other requested details.

Step 3: Report income

Next, report all sources of income you received during the tax year. This typically includes wages, salaries, dividends, interest, rental income, self-employment income, and other taxable income. Use the appropriate lines and schedules to report each type of income accurately.

Step 4: Calculate adjustments and deductions

If you qualify for any adjustments to income or itemized deductions, complete the corresponding sections or schedules. These can include deductions for mortgage interest, property taxes, state and local taxes paid, medical expenses, and charitable contributions, among others. Make sure to follow the instructions and fill in the appropriate lines or schedules for each deduction or adjustment.

Step 5: Determine tax liability and credits

After calculating your adjusted gross income, apply the California tax rates to determine your state income tax liability. Refer to the tax tables or tax rate schedules provided in the instructions. Additionally, consider any applicable tax credits you may be eligible for, such as the Child Tax Credit or California Earned Income Tax Credit. Subtract these credits from your tax liability to arrive at your final tax amount.

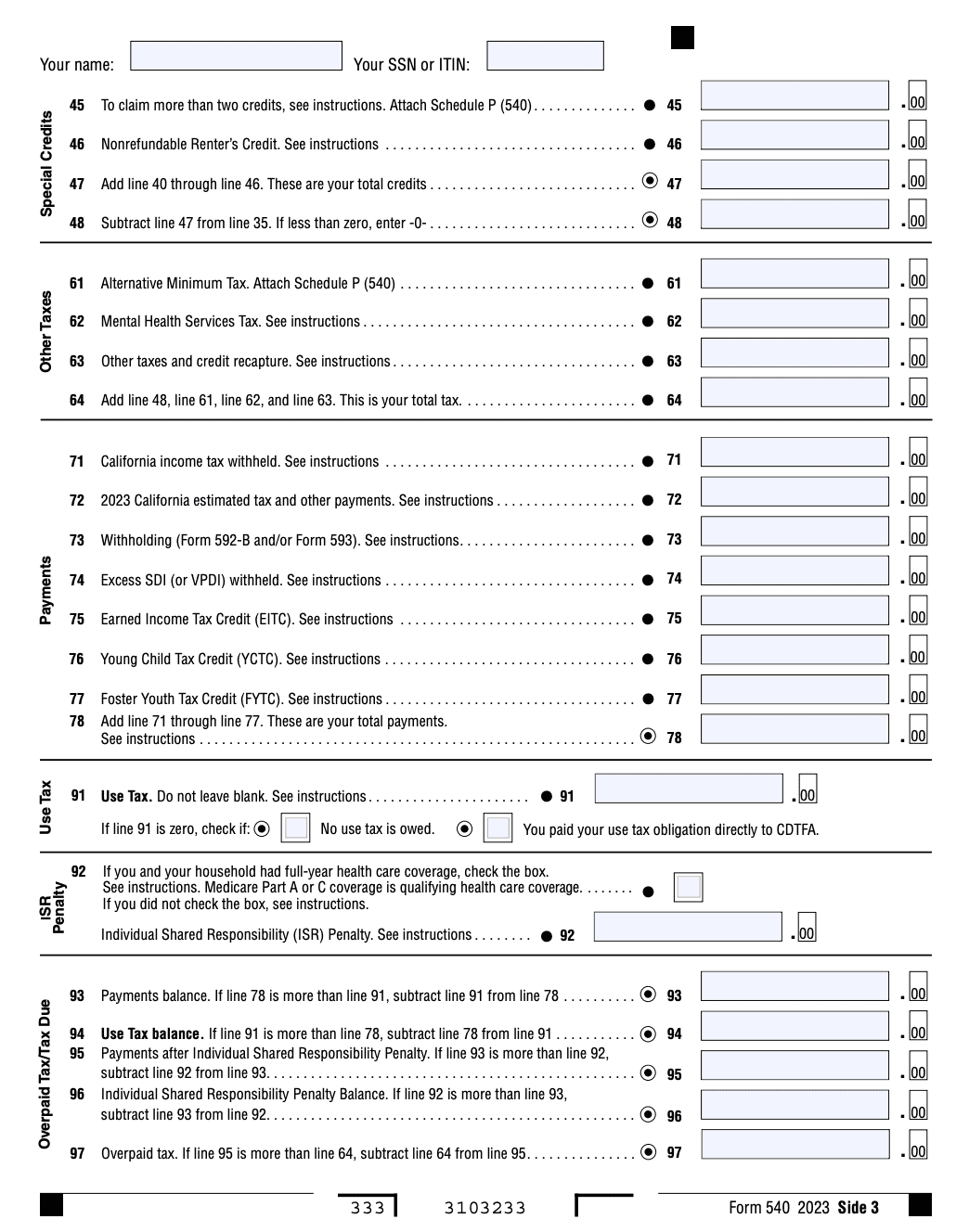

Step 6: Withholdings and payments

If you had taxes withheld from your wages throughout the year, enter the amounts on the appropriate line. Also, report any estimated tax payments or other tax credits you are entitled to claim. These will be used to determine if you owe additional taxes or are due a refund.

Step 7: Review and sign

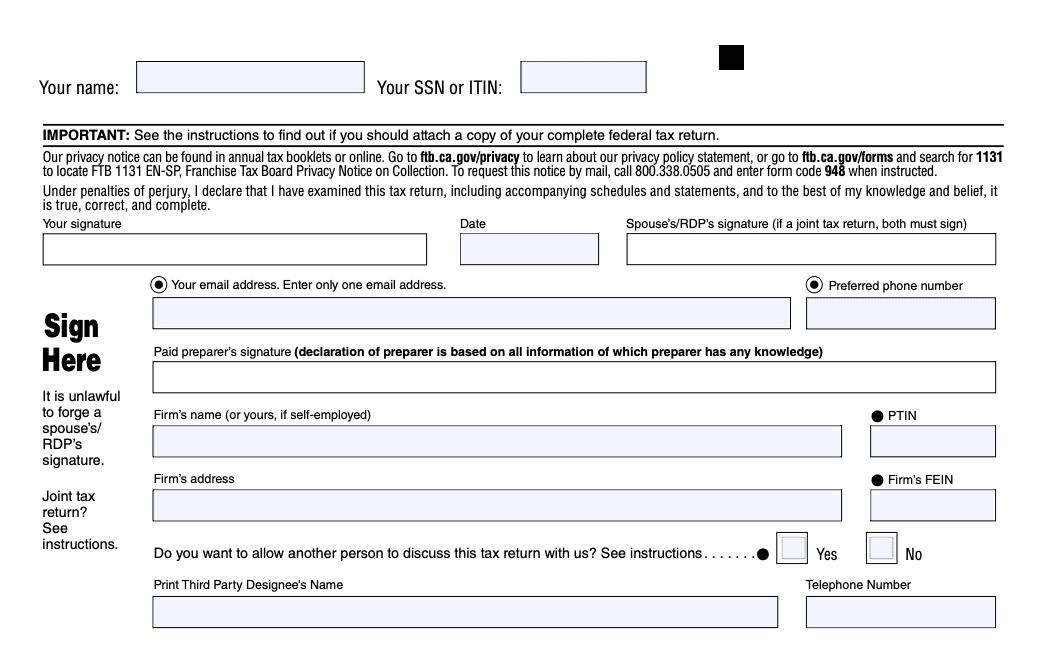

Go through the completed form carefully to ensure accuracy. Double-check all calculations, verify that you've entered the correct information, and review any supporting schedules or documentation. Once you're satisfied, sign and date the form.

Step 8: File and retain copies

Make a copy of the completed Form 540 and all supporting documents for your records. File the original form by mail or electronically, following the instructions provided by the California Franchise Tax Board. Be mindful of the filing deadline, which is usually April 15 unless it falls on a weekend or holiday.

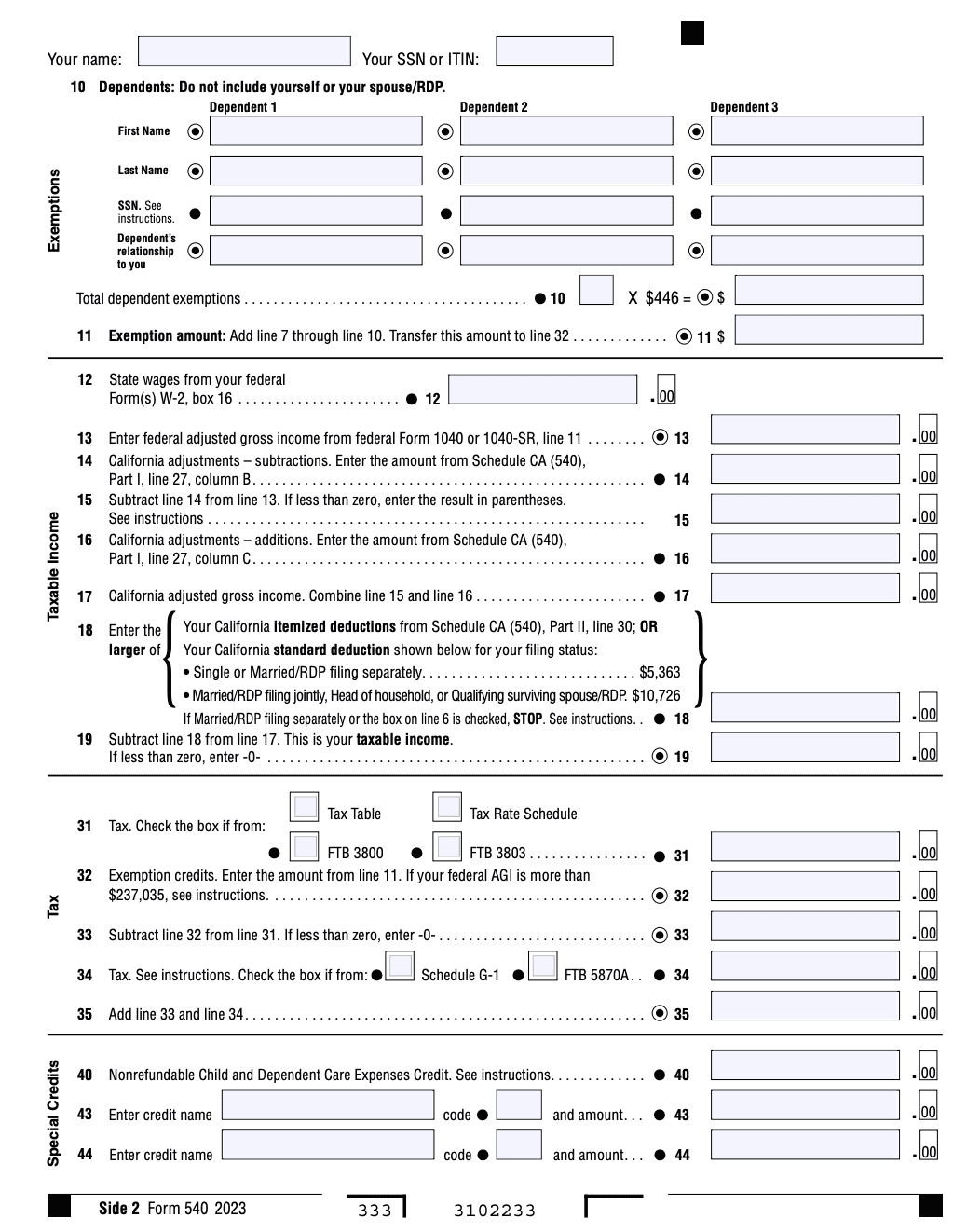

Types / Schedules / Deductions on Tax Form 540

Types of income

- Wages, salaries, and tips

- Self-employment income

- Rental income

- Interest and dividends

- Capital gains

- Retirement income (pensions, annuities, etc.)

- Unemployment compensation

- Social Security benefits

- Alimony received

- Gambling winnings

Schedules of Form 540

Schedule CA (California Adjustments): This schedule is used to report any adjustments to your federal income that are specific to California. It includes items such as rental income from California real estate, California lottery winnings, and certain deductions and credits.

Schedule D (Capital Gains and Losses): This schedule is used to report capital gains and losses from the sale of assets such as stocks, bonds, and real estate.

Schedule 540NR (Nonresident or Part-Year Resident): If you were a nonresident or part-year resident of California during the tax year, you may need to file this schedule to calculate your California tax liability based on the income earned or received in the state.

Tax Deductions of 540 form

Standard deduction: California offers a standard deduction, which is a predetermined amount that reduces your taxable income. The standard deduction amount varies depending on your filing status.

Itemized deductions: Alternatively, you can choose to itemize your deductions if they exceed the standard deduction. Common itemized deductions include state and local taxes paid, mortgage interest, charitable contributions, and medical expenses.

Dependent exemption: If you have dependents, you may be eligible for a dependent exemption, which reduces your taxable income.

California Earned Income Tax Credit (CalEITC): This is a refundable tax credit for low-income individuals and families in California.

Special Considerations When Filing Tax Form 540

When filing Tax Form 540, there are a few special considerations to keep in mind. Tax Form 540 is the Individual Income Tax Return for residents of California. Here are some key points to consider:

California-specific tax laws: California has its own tax laws and regulations that differ from federal tax laws. It's important to familiarize yourself with these state-specific requirements to ensure accurate filing.

Residency status: Tax Form 540 is for California residents. If you are a nonresident or part-year resident, you may have different filing requirements or need to use a different tax form. Make sure to determine your residency status correctly.

Filing status: Choose the correct filing status on Form 540. Options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Select the one that best reflects your situation.

Income sources: Report all sources of income, including wages, self-employment income, rental income, interest, dividends, and any other taxable income you received during the tax year. Ensure that you include both federal and California income on the form.

California adjustments: California allows certain adjustments to your federal income, such as deductions for contributions to California 529 college savings plans and interest on student loans. These adjustments are made on Schedule CA (540), which is attached to Form 540.

Credits and deductions: California offers various tax credits and deductions. Some common ones include the California Earned Income Tax Credit, Child and Dependent Care Expenses Credit, and Mortgage Interest Credit. Review the available credits and deductions to determine if you qualify and claim them appropriately.

Healthcare coverage: California has its own individual healthcare mandate. Ensure that you provide accurate information regarding your health insurance coverage for yourself and your dependents on the tax form.

Estimated tax payments: If you made estimated tax payments throughout the year, make sure to properly report them on Form 540. California also requires estimated tax payments if you anticipate owing more than a certain amount in state taxes.

E-filing options: California provides electronic filing options for tax returns, which can simplify the process and expedite your refund if applicable. Consider e-filing as a convenient and efficient method.

Review and double-check: Before submitting your tax return, carefully review all the information provided. Ensure that all calculations are accurate and all necessary schedules and forms are attached.

Common Mistakes To Avoid While Filing Tax Form 540

When filing Tax Form 540, it's important to avoid common mistakes that can lead to errors or delays in processing.

First, make sure to double-check all your personal information, including your name, Social Security number, and address. Any inaccuracies in this information can cause problems with the processing of your return.

Additionally, ensure that you select the correct filing status for your situation, as this can impact your tax liability and eligibility for various credits and deductions. It's crucial to accurately report all your income, including wages, self-employment income, and investment income. Take the time to review all your tax documents to avoid any omissions.

Don't forget to claim all eligible deductions and credits, such as student loan interest, mortgage interest, and education credits. Finally, ensure that you sign and date your return and attach any necessary documents.

If you're uncertain about any aspect of your return, consider seeking professional help to ensure accuracy and maximize your tax benefits. By avoiding these common mistakes and paying attention to detail, you can help ensure a smooth tax filing process.

Filing Deadlines & Extensions To File Form 540

Filing deadlines and extensions for tax forms can change from year to year, so it's essential to consult the most recent information provided by the California Franchise Tax Board (FTB) or a tax professional for the current year's deadlines.

Here are a few general regulations:

Original filing deadline: The typical due date for filing Form 540 in California is April 15 of each year. If April 15 falls on a weekend or a holiday, the due date may be extended to the next business day.

Extension deadline: If you need more time to file your California income tax return, you can request an extension. To obtain an extension, you must file Form FTB 3519, Payment for Automatic Extension for Individuals, by the original due date (usually April 15). The extension allows you an additional six months to file your tax return.

Extended filing deadline: With an approved extension, the extended filing deadline for Form 540 is typically October 15. You must ensure that your completed tax return is postmarked on or before this date.

| Item | Details |

| Form | California Form 540 |

| Extension Available | Yes, automatic six-month extension |

| Extension for Filing | Extension applies to filing the return only |

| Due Date for Payment | Taxes must be paid by April 15th to avoid interest and penalties |

| Extended Filing Deadline | October 15th |

| Penalty for Late Filing | Penalties applicable if Form 540 is not filed by October 15th |

Remember that these dates are subject to change, and it's crucial to verify the specific deadlines for the current tax year. You can visit the California FTB website or consult a tax professional for the most up-to-date information regarding Form 540 filing requirements, deadlines, and extensions.

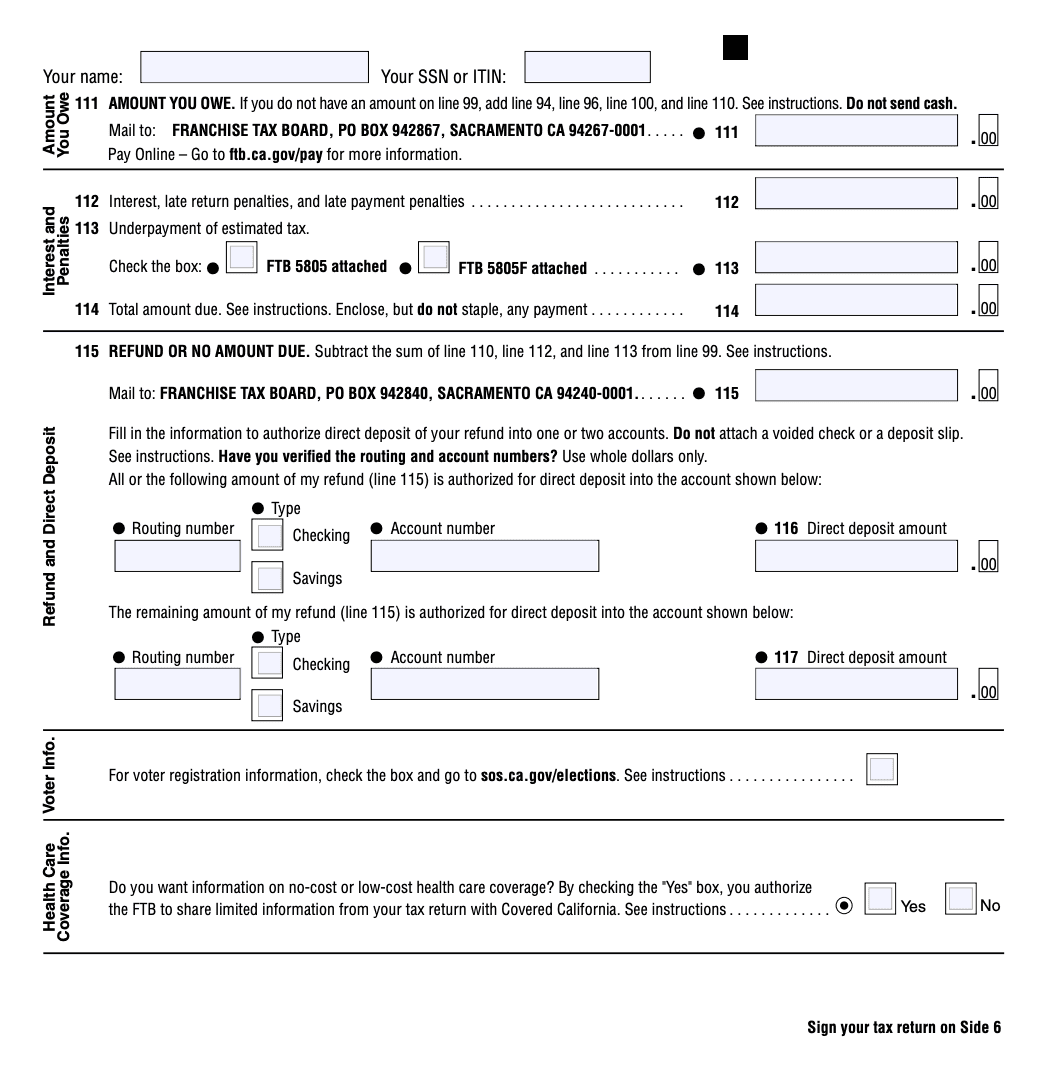

Mailing Addresses for California Form 540:

Whether you're a first-timer or a seasoned filer of Form 540, it's important to know the correct mailing address. Depending on your specific tax situation, use the addresses below:

For Returns Indicating a Refund, Zero Balance, or Balance Due without Payment:

- Franchise Tax Board

- PO Box 942840

- Sacramento, CA 94240-0001

For Returns with Payment:

- Franchise Tax Board

- PO Box 942867

- Sacramento, CA 94267-0001

Key takeaways

Tax Form 540 can be intimidating, but with a comprehensive understanding of its purpose, key components, eligibility criteria, and diligent preparation, taxpayers can confidently navigate the filing process.

By following the provided tips and seeking professional assistance when needed, individuals can accurately complete Tax Form 540 and fulfill their state income tax obligations while maximizing potential tax benefits. Remember, it's crucial to stay updated with the latest tax regulations to ensure compliance and optimize your financial position.

FAQs:

Here are some questions that people might have about California Form 540:

Do I need to attach Schedule CA 540?

Schedule CA 540 should be attached to your Form 540 if you need to make any adjustments to your income because of differences between California and federal tax laws. It's used to modify federal adjusted gross income and itemized deductions to align with California's tax rules.

Can I file CA 540 online?

Yes, you can file Form 540 online. The California Franchise Tax Board allows e-filing for several forms including:

- Form 540, California Resident Income Tax Return

- Form 540 2EZ, California Resident Income Tax Return

- Form 540NR, California Nonresident or Part-Year Resident Income Tax Return

E-filing is often faster and can lead to quicker processing of your tax return and any potential refund.

What is the purpose of column C on Schedule CA 540?

On Schedule CA 540, Column C is used to add amounts to your income as calculated on your federal tax return, when required by differences in California and federal tax laws. This column, along with Column B (which is used for subtractions), adjusts your federal amounts to the correct figures for California tax purposes. Always enter these adjustments as positive numbers unless otherwise instructed.

How far back can we amend CA 540?

You can amend Form 540 up to two years from the date of paying an assessment, but only if the amendments relate directly to the issues raised by that prior assessment. Furthermore, any refund claimed on the amended return cannot exceed the amount of tax that was paid on the original assessment.

How do I file a joint return using Form 540 if my spouse and I are both California residents?

Married couples who are both California residents can file a joint tax return using Form 540, which involves combining their incomes, exemptions, and credits on one return.

Are there any special versions of Form 540 for specific situations?

Yes, besides Form 540NR for non-residents, there's also Form 540 2EZ for certain filers with simpler tax situations. This form has restrictions based on income sources, adjustments, credits, and filing status.

Is there a penalty for filing Form 540 late?

Yes, if you file your return late and owe tax, you may face a late filing penalty plus interest on the tax owed from the original due date until the tax is paid.

What should I do if I can't pay the full amount due with my Form 540?

If you can't pay the full amount, you should still file your return on time and pay as much as you can. You can then apply for an installment agreement to pay the remaining balance over time.

What is the process for requesting an installment payment plan for taxes owed on Form 540?

If you owe taxes and cannot pay in full, you can request an installment payment plan through the California Franchise Tax Board website or by contacting their customer service. You'll need to provide financial information and possibly a down payment. You can call at 800-689-4776.

What to do if I receive a notice of audit for Form 540?

If you receive a notice of audit for Form 540, it's important to respond promptly and gather all relevant documentation supporting the entries on your tax return. Consider consulting with a tax professional for assistance throughout the audit process.

What is the penalty for late filing?

The penalty for late filing is usually 5% of the unpaid tax per month, up to a maximum of 25%. Interest may also be charged on any unpaid tax from the original due date.

How do I correct a mistake on my Form 540 after I’ve filed it?

If you discover an error after filing, file an amended return using Form 540X to correct the mistake.

Can I split my refund into multiple bank accounts?

Yes, you can split your refund into multiple accounts using Form 8888, Allocation of Refund (Including Savings Bond Purchases).

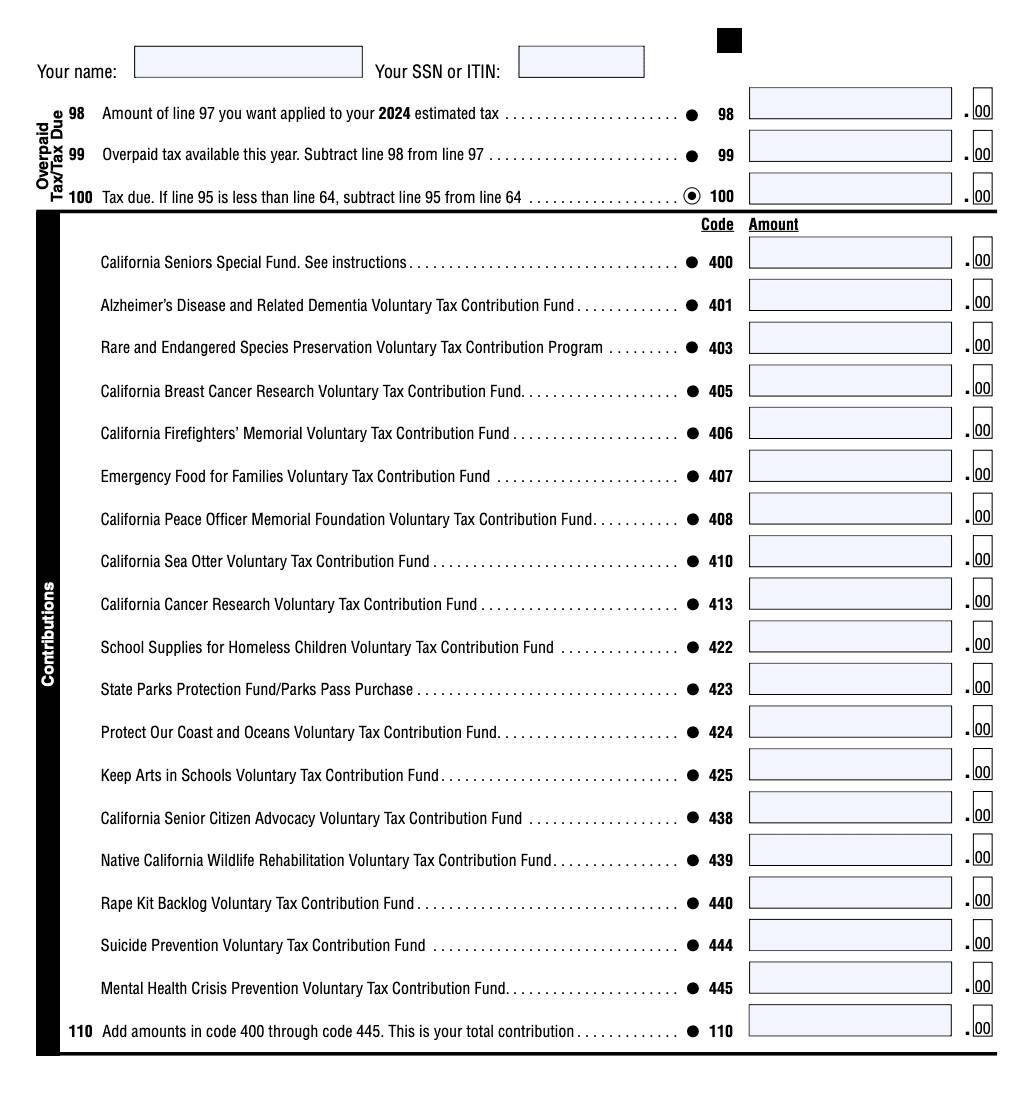

What is the Voluntary Contribution Fund?

California allows taxpayers to make voluntary contributions to various state programs and charitable organizations. These contributions can be made directly on Form 540.

What’s the difference between Form 540 and Form 540 2EZ?

Form 540 2EZ is a simpler version of Form 540 for taxpayers with straightforward tax situations. It has fewer lines and simpler instructions, but not all taxpayers will qualify to use it.