Better bookkeeping

Meet Fincent — The only solution that combines beautiful software, human bookkeepers, and obsessive customer support. Now you can grow your business, keep costs down, and still have time for life

Leave the old ways behind

240+

hours freed up every year

24x7

access to financial reports and insights

$11k+

saved annually on bookkeeping and taxes

For us, Fincent is not just a service; they are a strategic partner in our growth story.

Cody Franklin • Unified IT

“Fincent has transformed my financial management.”

Grant Sapkin • Burrrst

"Super easy, super supportive, and super responsive."

Dr. Kwab Ofori-Ansah • PhysioCare Rehab & Wellness

Businesses, big and small, trust Fincent with their books

Squeaky clean books

Get up-to-date, balanced, and verified books by the 15th of every month

Reconcile books that haven’t been updated in ages with Catch-Up Bookkeeping

Use the default accrual-basis method or request that your books be maintained on a cash-basis

Watch the money roll in

Create digital invoices, request payments, and remind customers about overdue bills

Bear the transaction costs yourself or bake it into your customers’ invoices

Give your clients the option to pay you through ACH, credit, or debit cards

Stay two steps ahead of the IRS

Receive year-round support to file both your business and personal taxes

Outsource every step of the tax filing process for your your S-Corp, LLC, or any other type of business entity

Get a professional to prepare, review, and verify your forms before you sign it

Trusted by legendary business owners

“Fincent has saved my business over $25k in just a few months. I've now onboarded three of my companies to the platform — the team does a great job of categorizing expenses and the dashboard makes it easy to review everything.”

Sophia Amoruso

- Built 3 multi-million dollar companies

- 15+ years of experience as a business owner

- Featured on America's Richest Self-Made Women List, 2016

The perfect solution does exist.

It's staring you in the face.

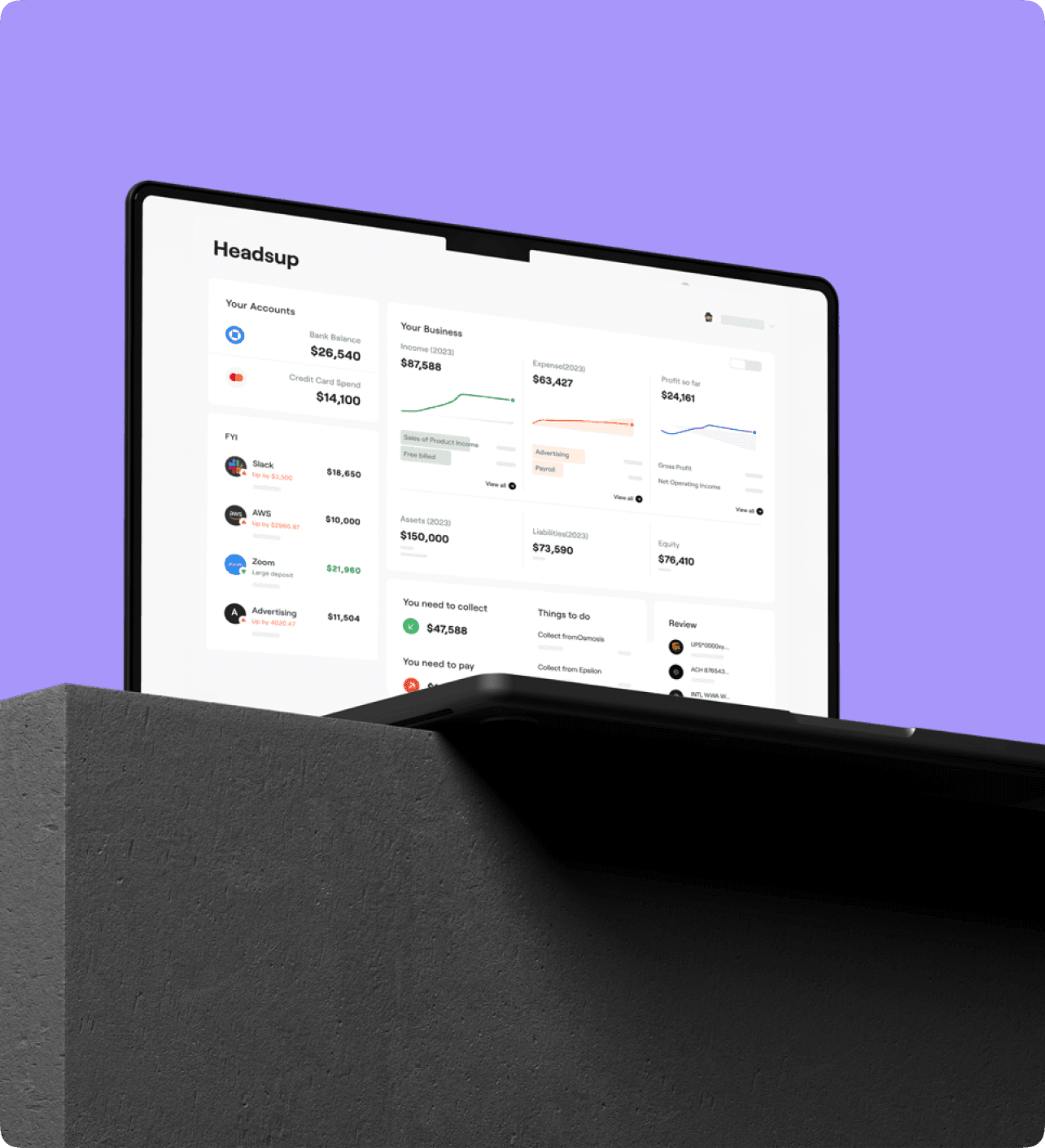

Powerful Search

Find invoices, transactions, and subscriptions quickly with Fincent's built-in search engine.

Powered by real bookkeepers

Your dedicated bookkeeping team with 100+ hours of experience is always just a DM away.

Never out of sight

Forward email invoices or upload images of bills and see them magically appear in your books.

Your financial chat history

Track average spends, lifetime costs, and total earnings for every vendor, subscription, and customer.

Plugs and plays

Start afresh or pick up where you left things off by importing your QuickBooks files into Fincent.

Vendors will love you

Pay vendors through your connected bank accounts or credit cards right from within the app.

Export ready reports

Gather deep insights around your financial operations with readymade P&L statements, balance sheets, and cash flow reports.

Kelsey WilLock

Founder, Aura Finance

“Fincent is intuitive, easy to use, and a lifesaver. It has significantly reduced costs and saved us countless hours on financial tasks.”

Kelsey WilLock

Founder, Aura Finance

70%

transactions auto-categorized

30+

reports created

Gaia Richards

Founder, Blue Earth Healing

“Fincent, a reliable crew, handled my books with care, offering invaluable financial clarity on our business journey.”

Gaia Richards

Founder, Blue Earth Healing

80%

Reduction in Manual Financial Tasks

60%

Boost in Tax Compliance

Cody Franklin

Founder, Unified IT

“Fincent transformed our finances, enabling us to innovate. Their dedication makes them a strategic partner in our growth.”

Cody Franklin

Founder, Unified IT

80%

transactions auto-categorized

30+

reports created

Find out how much

you can save

Bookkeeper’s hourly rate

55

>$400

Monthly expenses

50

500k+

Thinking about pricing?

We'll take the price challenge!

Our customers consistently recognize Fincent for delivering high-quality software and expert service. Our pricing is the most competitive in the small business accounting space.

“Wait, my next Acme Inc. subscription is going to cost me $4000?”

Grow smarter and slash competition with strong financial data on your side.

Get startedGreat on its own but also connects with your favorite tools

Flip through some flippin' good resources

How is Bookkeeping Different for Marketing and Advertising Agencies

By setting realistic marketing budgets, identifying tax-deductible expenses, and streamlining reconciliation and reporting processes, marketing agencies can optimize their financial management. These practices contribute to improved financial stability, better decision-making, and long-term success in the dynamic marketing industry.

Read moreSmall Business Bookkeeping 101

Learn how small businesses can handle bookkeeping effectively and scale faster with clean books.

Read moreNever Run Out of Cash Again: A Founder's Guide to Cash Flow Health

Learn all about cash flow health so your business is stable in the long run.

Read moreSmall Business Tax Filing: What You Need Before You File

Learn about the basics of tax filing, mistakes your need to avoid, and go through our tax preparation checklist to have a smooth tax season.

Read moreWhat are Vendor Payments and How Fincent Makes It Easy

Learn all about vendor payments, how the process works, and how Fincent can help you automate the process.

Read moreWhy Should Small Businesses Automate Account Reconciliation

Read how automated account reconciliation can save you time and money and reduce errors for improved financial health.

Read moreManual vs Automated Expense Tracking: What’s Better for Your Small Business

Read about the difference between manual and automated business expense tracking and see what your business needs.

Read moreWhat is Transaction Auto-Categorization? How Does Fincent’s Auto-Categorization Feature Work?

Read how transaction auto-categorization helps you understand your finances better and how Fincent is using AI to improve the process.

Read moreHow AI Improves Accuracy and Reduces Errors in Bookkeeping

Learn how AI-powered bookkeeping solutions help you minimize errors and ensure accurate financial reporting.

Read moreSee more to believe more

Take it for a spin

Learn how Fincent manages your finances in this interactive product tour

Take a tourWatch it in action

Check out a pre-recorded walkthrough video of the product and all the things it can do.

Watch the demo